The case for Real Estate

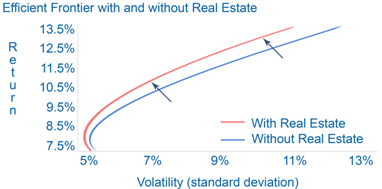

Diversification into commercial real estate has been shown to enhance overall investment returns. Successful investment strategies are often geared toward achieving what finance experts refer to as the “efficient frontier”, the highest possible return for a given level of risk and associated volatility. Portfolio diversification, through the addition of directly owned commercial real estate, may lower portfolio volatility at all return levels.

Mitigate the damaging effects of inflation

The inclusion of direct real estate ownership into a diversified portfolio of investments may reduce a portfolio’s exposure to the negative effects of inflation. Given its historical positive correlation with changes in consumer prices, private real estate investment may provide a partial hedge against inflation. As consumer prices rise, so can real estate cash flows and, typically, associated property values. Also, many commercial lease contracts contemplate fixed yearly rental increases, providing property owners with an additional layer of inflation protection.

Defense against recession

While equity and fixed income markets typically move in tandem with economic cycles, income from real estate assets often benefits from multi-year leasing contracts. As a result, properties may generate steady and predictable revenue streams apart from the relative growth of the general economy. G2 Capital assesses the creditworthiness and predictability of a property’s income stream and we adjust our underwriting and value expectations accordingly.

Market inefficiencies create opportunities

Because equity and debt markets are priced globally by millions of investors each minute of the day, they are widely considered to be efficient. Therefore, prices already reflect all known information and reflect the collective beliefs of all investors about future prospects. In contrast, real estate markets are often considered to be inefficient which provides many value enhancement opportunities for private investors with the information, discipline, and expertise to identify and capitalize on them.

Direct Real Estate Investment VS. Public Reits

The use of publicly traded REITs may fail to accomplish the goal of portfolio diversification into the real estate sector. The performance of publicly traded real estate shares are closely correlated to that of other equities, while the correlated returns for private real estate ownership has historically been very low. This low correlation further reflects the counter-cyclicality of real estate and its potential for performing well when equity markets are in decline. Furthermore, REITs are required to distribute 90% of their operating profits in the form of current income, a requirement which may compromise longer term operating strategies. Direct investment in real estate also may offer private investors better control over tax efficiency and consequences.